|

I was a mortgage broker a little over 5 years ago and personally experienced that end of these crazy low rates. Everyone was scrambling to refinance and get pre approvals locked in, business was good. Now we are seeing a competitive shift once again towards offering the best rate. What does this mean for you as a buyer? Now you can afford another $50,000 on a mortgage! Seems great right? Realistically as a buyer in any range you should still stick with the price range you were in with the higher interest rate. This will avoid a bad situation in 5 years when your mortgage comes up for renewal and the rates may be higher. What this does mean for you is that you should get a rate locked in and log on to www.viewpoint.ca to find your next home. For you sellers, call today and get your house listed asap to avoid a little competition from the neighbours.

Here a great article from The Globe and Mail about how the rates are already effecting our market; Canada’s housing market is already seeing the impact of falling interest rates, with nearly half of Canadians telling a new survey that they are planning to buy a home in the next five years and more than 15 per cent saying cheaper mortgage rates will allow them to make the purchase sooner than expected. Regionally, the demand among buyers is strongest in Ontario and Atlantic Canada, where the combination of low interest rates and cheaper oil prices are poised to put more money in the pockets of consumers. Nearly a fifth of residents told pollsters that they would speed up their home purchase because of low interest rates. In contrast, just 13 per cent of residents in Quebec and 12 per cent in Alberta said lower rates were having an impact on their buying decisions. Plunging oil prices have made Alberta consumers more cautious about jumping into the housing market this year, while a high vacancy rates and a glut of newly built condos in Quebec is pushing more potential first-time buyers into the rental market, according to Desjardins Group. Mortgage rates have been falling since last week, when the Bank of Canada shocked markets by cutting interest rates by 25 basis points ( a basis point is a hundredth of 1 per cent.) Lenders soon followed, with major banks dropping five-year fixed rates mortgages to as low as 2.84 per cent and this week cutting their prime rates by 15 basis points, which quickly pushed variable-rate mortgages among the Big Six banks as low as 2.25 per cent. On Friday, BMO said it was lowering rates on several of its fixed mortgages. The rate on a 10-year mortgage, for instance, fell 85 basis points to 3.84 per cent. Many analysts had predicted that interest rates would rise this year, so the central bank’s unexpected decision to slash rates is widely expected to reignite the country’s cooling housing market. “Given the negative impact of lower oil prices on the Canadian economy, interest rates are likely to remain low for some time, supporting home sales, especially in Vancouver and Toronto where affordability is an issue”, said BMO senior economist Sal Guatieri. But with mortgage rates falling only slightly and more Canadians telling the BMO survey they were planning to use lower rates to pay down their debt rather than load up on new ones, cheaper rates are expected to have a modest impact on the housing market. Shortly before the Bank of Canada cut its target overnight lending rate, more than half of Canadians told an earlier BMO poll that cheaper rates would make them more likely to buy a home, though most said the drop would need to be 10 per cent or more to have a significant impact on their buying plans.

0 Comments

Time and time again I show homes that, well, are not pleasing to show at all. When this happens my clients spend the majority of their time (which is short in these homes) talking about "how can they show other people their home like this" or "why wouldn't they just do that, or move this or hide whatever". We all have different ideas of what looks good and what doesn't, but heres a tip, if you have a good realtor they show hundreds of homes a year. So why not listen to them. It could be that sellers simply assume that potential buyers can look past the clutter and see the beauty and space of a room. Or they are too proud, thinking that they don't want someone who judges them on how they live to buy their home anyways. Or the Realtor is too afraid to give you advice that is strictly professional and not personal on home to present your home. Look at it like this, if you went to buy a car and the trunk was full of boxes and the seats covered in clothes and other personal belongings......what is the likelihood you would take it for a test drive? To go along with this tid-bit is a great article found in Forbes. It has fantastic advice that can certainly help sellers give themselves a fighting chance in a not so great market. Enjoy!!

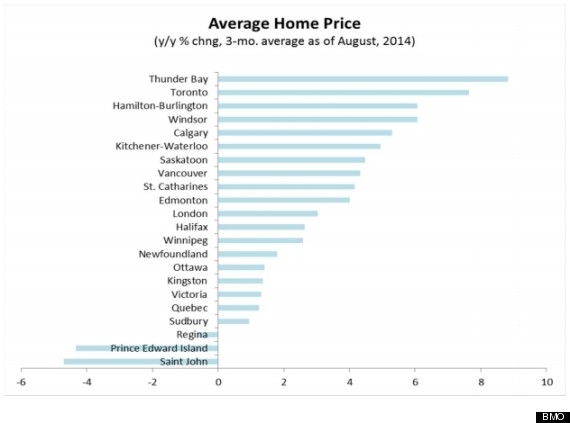

You’re about to put your house on the market! Congrats—that’s a big move. When that for-sale sign goes on the front lawn, dozens of eager real estate agents and many potential buyers will stampede through your front door and into every room of your house. You’ll have strangers combing through every nook and cranny of your house –and your life that you live there. Selling your home is such a huge financial undertaking that you want to give your home the best opportunity to sell for the highest price—but you still have to live there. Is there a way to honor both? You bet!Follow these key survival steps: Start Packing NowAs of this moment, you may only have 90 to 120 days until sale day and that moving truck arrives—or less! So keep in mind that you’re not going to need many of the extra space-gobbling items that are currently filling your rooms and closets over the next few months. So, if it’s May and you live in Pennsylvania, you won’t need those winter clothes. Pack them up! The secret to getting a house clutter-free is to remove the things you can live without while your home is on the market. That’s the mindset you’ll have to have as you go through each room and closet. With that it mind… Save it, Store it, Sell it, Chuck it or Donate it!Clutter eats equity and kills deals. The concept of less is more--clutter removal and the creation of space—is at the heart of preparing to sell a home, because space is an extremely precious commodity. Having a little extra breathing room and a sense of expansiveness in your home feels luxurious, rich, calming and uplifting. And, as obvious as this seems, a buyer will naturally be drawn to and pay more for a home that feels like it has extra space than one chock full to the ceiling with stuff. And more importantly, it’s an essential step in preparing your home for an upcoming move. Get Squeaky CleanOf course your house not only has to look good and be clutter-free, but it needs to be spotless. Kiss cobwebs, dust, grime, rust, mildew, and stains goodbye! I know, no one likes to get on their hands and knees and scrub. You’ll say, “I have never cleaned the house so thoroughly before!” Well, if you can make $5,000 to $10,000 more at sale time, I’d say it’s worth it! You should be able to eat off the floors. The windows, glass and mirrors must sparkle. The sinks and toilets should look ‘five-star hotel perfect.’ Maintain Your Privacy and SafetyBelieve it or not, people will look through your drawers, closets, and medicine cabinets at open houses or showings. Make sure your listing agent is clear to other agents that they should always be accompanying their prospective buyers. Also, don’t keep anything in the house that you don’t want anyone else to see. That includes personal documents and valuables. Never leave mail sitting around. Lock up all checks, credit cards or any other information that would be of use to an unscrupulous “home buyer.” Lock up or remove all prescription medicine bottles. Be sure to enable passwords on your in-home computers and laptops. And if you have a diary or journal, don’t leave it bedside! Be extra cautious about anything of monetary or sentimental value. When in doubt, put it away and lock it up. Send your Pets On A HolidayI love animals! I have a wonderful welsh terrier pup that I rescued a few years ago, so keep in mind that this advice is all about helping you get your house sold and not neglecting your little furry family members. When putting a house up for sale and taking the pictures for the online listing, pre-arrange with friends and family to take your pets for the day. Come opening day, when your home hits the market and the open houses and showings begin, plan on boarding your pets elsewhere. It takes a bit of planning, but it’s oh-so necessary. Prep Like A Pro I want to mentally prepare you for the work it takes to sell a house. When you are living in the house, you need to be prepared to “Show Prep” your house for each showing. Even though my real estate agents are fantastic, they are busy and they often arrive at the same time as the buyers. They may not have the opportunity or time to prep the house. When those buyers arrive, you must have this houseon! Every light set perfectly, the music softly playing, the fireplace going if it’s cold, the doors and windows open if weather permits, and the temperature exactly right. Remember you want to your house to be seen at its very, very best. Involve Your Kids In The ProcessIf you have children, you have a lot of stuff! And of course, your kids need to be able to play and continue on with their everyday lives. So how do you get the house looking perfect for every showing? Involve your kids. Make the process a game and get them to participate. Let them understand that it’s time to put the house “on show” and you all need to set the stage together. Have them pick their favorite toy and stuffed animal to showcase in a perfect spot each time for the show, and put the other toys away. You will be surprised how cooperative the kids are and how much fun they have when you yell “Show Time!” Get It Ready and Get OutOnce you have gone through the checklist of everything that needs to be done before each showing and the house is ready for its close up, get out! You want the potential buyers to feel that this is their beautiful house. After you have worked so hard to control every aspect of their experience, don’t muck it up by lurking around. You’ll spoil the fantasy—and the sale. And every real estate agent will tell you, the worst thing a seller can do is hover around prospective buyers and their agents. They need the ability to speak openly and candidly to both your agent and the buyers. Final Panic: “I Can’t Live Like This!” – Yes You Can!You’ll wonder, “How can I keep the house this perfect or this clean forever . . . and where are my things?” Well, don’t worry! If you truly dress your up house for sale, it’s going to sell right away and you’ll be moving soon. Since your things are packed, well-organized, and edited down to what is essential, because you purged your closets and cleaned out the garage, moving will be a snap. You’ll be shocked at how little you actually need for the three months your home is on the market. ***The above article is compliments of www.forbes.com***  If your like me, a proud Nova Scotian with no desire to to head West, the news headlines surrounding the housing market generally don't apply to you. Traditionally we had a fairly stable housing market where you could buy a home and could expect a decent, not huge, equity increase each year. Now we are approaching the end of our second worse year in over a decade. Homes that were purchased during the shipyard announcement are those that have been hit the worst but you can see with the shear volume of listings sitting on the market that everyone is feeling the blow. Sure there's issues with the tightening of mortgage regulations but on the flip side we are seeing some of the best rates both fixed and variable in years. So what is the problem? Why do we have a "Buyers" market but no buyers? Why are homeowners still listing record numbers of homes each week with record low sales? These are the questions that never seem to get addressed in the news in Canada but impacts our lives everyday. It is because of the above that I have chosen to highlight the following article in this weeks blog. Its about time that our market issues are somewhat acknowledged. "The headlines are clear: Canada’s long-running housing boom shows no signs of ending, with sales rising yet again, by 1.8 per cent, in August. The average house price is up 5.3 per cent in the past year, according to self-reported numbers from the real estate industry, and that's well above wage growth and inflation. But beneath the surface lies another story — one of two divergent housing markets. On one side is, basically, Toronto and everything west of it, markets which have been seeing strong price and sales growth. On the other side is everything east of Toronto — where the housing market has cooled considerably. (There are some exceptions.) In a client note Tuesday, BMO economist Robert Kavcic pointed out that house price growth has largely been driven by three cities where prices, some argue, are getting out of control: Calgary, Toronto and Vancouver. Kavcic published a chart showing some alarming house price drops in a few cities — including in one city in booming Saskatchewan: Calgary, Toronto and Vancouver are seeing something of a resurgence of their housing booms — that is, if the boom ever really went away. Home prices in these cities are seeing growth rates well above wage growth and inflation, a situation most economists say is unsustainable. Single-family homes in Calgary are up more than 10 per cent over the past year; average house prices in Toronto, including condos, are up 8.9 per cent over the past year. Vancouver saw the most moderate growth of the three, at 5 per cent. Outside of those three cities, the housing market looks much cooler than the national numbers suggest. Home sales in Ottawa, for instance, dropped 1.1 per cent even as prices rose 3.4 per cent. Home prices in Kingston, Ont., are down about 2 per cent. This disparity in housing markets is making it difficult for policy makers. TD Bank CEO Ed Clark this week called for tighter mortgage regulations, to ensure Canadians aren’t getting themselves into too much debt. But given the weakness in some markets, making mortgages harder to get — whether through tougher rules or higher interest rates — could backfire in some parts of the country. “I’m not sure [any] markets are so hot they need dousing,” BMO chief economist Doug Porter told the Financial Post. “If you hit the market with something like tighter mortgage rules, that could send some already weak markets into a tailspin. Policy makers are in a tough bind.” Parts of the country where prices have fallen, according to the industry: — Annapolis Valley, N.S. — Brandon, Man. — Chatham/Kent, Ont. — Kingston, Ont. — Owen Sound, Ont. — Prince Edward Island — Moncton, N.B. — Northumberland County, Ont. — Regina, Sask. — Saint John, N.B. — Sudbury, Ont. ***Article compliments of the Huffington Post*** The question that comes up more and more in the country’s expensive housing markets is: Where are first-time buyers getting the money?

Parental help is a big factor, so much so that the federal agency Canada Mortgage and Housing Corp. has launched a study of the phenomenon. Also, it’s virtually a given that today’s buyers will raid their registered retirement savings plans to use the federal Home Buyers’ Plan. And then there are savings – money put away week by week over a period of years to build a down payment. I took a look at housing affordability in a recent column and concluded that heroic savings measures are needed by anyone hoping to buy in expensive cities such as Vancouver, Calgary and Toronto. In other words, sacrifices must be made on all your spending, from the day-to-day to special occasions. Here are nine ways to power-save your way to a house down payment in any city: 1. Move in with your parent or in-laws Explain that you’re thinking strategically in moving back home. The quickest way to get into the housing market is to maximize savings, which is difficult to do when you're paying the cost of rent in a big city. You’ll pay your parents a token amount of rent, but most of your savings will go directly into your house down payment fund. Tell your parents to think of the grandchildren you’ll be raising in the house you’re saving for. Yearly rent at $800 per month: $9,600 Minus token rent payment to parents: $2,400 One-year savings: $7,200 2. Move down one level of rental. If you have a two-bedroom apartment, try going down to one bedroom. Or, trying squeezing into a bachelor apartment. You could also look at moving to a cheaper part of town, as long as it won’t jack up your commuting costs. Get rid of stuff that won’t fit in your new, smaller place, or store it in your parents’ basement. Don’t spend money on a storage unit. Yearly rent at $800 per month: $9,600 Minus yearly rent at $650 per month: $7,800 One-year savings: $1,800 3. Sell your car and take the bus. You’ll be saving on fixed costs such as parking, insurance, gas, maintenance and possibly car payments, and you’ll be protected against the risk of financially catastrophic four-figure repair bills. Rent a car or use a car-sharing service for those times when the bus won’t cut it. A cheap bike will help you save on bus fare. Estimated annual cost of gas, insurance and maintenance and parking: $5,000 Minus estimated annual cost of a bus pass and occasional car rental: $1,500 One-year savings: $3,500 4. Stop buying lunch. A pain, but worth it. You’ll have to think ahead by either picking up the right groceries to make your own lunch, or by scooping up after-dinner leftovers. Healthier than your food-court lunch, which you’re probably sick of anyway. Estimated cost of buying lunch at $8 or so per day: $2,000 Minus cost of spending about $15 per week to stuff to make your lunch with: $750 One-year savings: $1,250 5. Dial down you vacations. New York is out. Maybe Buffalo. For West Coasters, maybe Seattle instead of Hawaii. Use the likes of Airbnb (airbnb.ca) to find cheap accommodations instead of staying in a pricey hotel. Or stay home and use some of the money you saved on hotels to try some nice restaurants in your town. This is good practice for when you own a home and find that fancy vacations are unaffordable without going into debt. Summer vacation somewhere in the U.S.: $2,500 Minus the cost of a Staycation: $500 One-year savings: $2,000 6. No pets. Buy a house, and then get a dog, cat, ferret, parakeet or whatever. Pets don’t cost a lot on a day-to-day basis, but vet bills will blow your mind if something goes wrong. Protect your house down payment fund. Food, vet, toys etc.: $500 One-year savings: $500 7. Put a $100 price limit on birthday presents. Extravagant presents are fun to both give and receive. But they’re a luxury for people who are more financially settled than someone who is madly saving for a house down payment. Yearly cost for a couple of buying presents for various occasions: $1,000 Minus using the $100 present limit: $500 One-year savings: $500 8. Cut your cable TV and landline Almost like heat and hydro, an Internet connection is essential. But a home phone is dispensable if you have a smartphone, and cable TV can be replaced by Netflix, watching shows online and using an HDTV antenna. Also, try buying up DVDs of movies and TV show seasons at garage sales, or find stores that sell used DVDs, CDs and videogames. Yearly cost of cable and home phone: $1,200 Minus approximate cost of a Netflix subscription: $110 One-year savings: $1,090 9. Halve your spending at restaurants and bars. Studies of Generation Y spending habits show that going out to eat and drink is big. Hey, everyone needs a hobby. But this one is too expensive for people who are set on buying a house. Aim to eat out less often, and rather than pay marked-up restaurant or bar tabs, grab a beer from the fridge. Annual cost of spending $250 monthly: $3,000 Minus half that annual cost: $1,500 One-year savings: $1,500 TOTAL ONE-YEAR SAVINGS FROM ITEMS 1-9: $19,340 **This fantastic article is compliments of www.theglobeandmail.com** Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but arn't quite sure? Thinking about when you should set out to make a purchase? I can quickly provide complimentry pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. A Shanghai-based company says it is planning to invest up to $3-billion in Nova Scotia in real estate, technology and tourism over the next decade, hoping to compete with Canada’s West Coast as a tourist centre for Chinese visitors.

There are some 100 million Chinese tourists now travelling the world “There are some 100 million Chinese tourists now travelling the world and so this is an opportunity to start taking advantage of that cohort,” said Stephen Dempsey, Canadian advisor to Dongdu International Group (DDI). He said he wanted Chinese visitors to discover that Canada has “another coast.” The company announced plans Tuesday to build residences and resorts in rural areas, develop technology in the capital region and enhance tourism and opportunities. DDI expects to increase investment activities as of September. Nearly 300 Chinese delegates and local entrepreneurs attended the announcement with Nova Scotia Business Inc. and Greater Halifax Partnership. “The DDI organization have a vision of really becoming for Nova Scotia one of its largest employers,” said Paul Kent, the president and CEO of the Greater Halifax Partnership. “It’s the first time that we’ve had very significant interest from a Chinese firm.” Dongdu CEO Marvin H. L. Li said Nova Scotia’s scenery, educated population and transportation possibilities make the province a “compelling” location for DDI to establish its first Canadian location. Last year, the company acquired and refurbished the historic Pacific Building in Halifax and now holds nine properties and a property management firm in Nova Scotia. And it hopes to develop a Chinese film industry in the province. The 25-year-old company also has business interests in east China, southwest China, Hong Kong, California and Detroit. First a real estate developer, DDI diversified its business into multi-purpose real estate, high-technology, private members clubs and residences. “We’re just getting started,” said Mr. Dempsey. “But it is symbolic of the potential that Nova Scotia and DDI see in each other.” Investment in major projects is at an all-time high in Atlantic Canada with 439 projects and a record $122-billion in investment, according to a report released Monday by the Atlantic Provinces Economic Council. Nova Scotia experienced the largest increase in investment, which totals $55-billion. Craig Wright, chief economist for Royal Bank of Canada, said housing affordability — and the resulting boost in demand — might be a part of Nova Scotia’s appeal. Atlantic Canada remains one of the most affordable areas to purchase a home in the country, according to RBC’s housing affordability report released on Tuesday. He said consumers have done a lot of the heavy lifting to spur growth. “Any acceleration in economic activity has to come from exports and investment,” Mr. Wright said. “If investment is picking up, it’s good news in the short run for the economy and in the long run for productivity.” Mr. Kent of the Greater Halifax Partnership believes the Chinese company is an economic push the province needs. “For Nova Scotia to catapult forward — and not just playing the incremental game — you really need an opportunity like this.” *Article compliments of the Financial Post, Economy section* Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but arn't quite sure? Thinking about when you should make the move and set out to make a purchase? I can quickly provide complimentry pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. Buying your first home with your significant other can be an exciting opportunity to make your dreams come true – or end up a stress-filled journey into the unknown. Here are some tips to keep your relationship on steady ground while avoiding costly mistakes.

Make sure you’re on the same page. Chances are that you and your partner have different ideas about the home you should buy. One of you might want a home in the suburbs, while the other is picturing a swank urban retreat. He is up for the challenge of a fixer, while you are wary of his handyman skills. You want a large yard for the dog but he dreads the upkeep. There are many decisions to be made regarding location, style and condition so before you begin your search have a frank discussion about what each of you wants and understand where you are both willing to compromise. Get your ducks in a row. Start by ordering your credit reports and checking for any inaccuracies or negative items. However, before you start paying-off that 5 year old collection account, check with a mortgage professional about what you should and should not pay-off or challenge. Often any activity on an account, even if paying-off a debt, may have a negative impact on your credit score. Sharing credit information is often a sensitive matter for couples. Lenders place more weight on the lower scoring partner, so now is the time to work together to improve your joint credit profile. Take a hard look into your wallet. Pre-qualification for your mortgage is a must. Most professional agents won’t even show you a property unless they know exactly what you can afford and that you have a pre-qualification letter to submit with an offer. Work with a mortgage professional and learn about the various types of loans available and exactly how much you can borrow. It’s also important to discuss with one another how much of your monthly income you’re comfortable allocating to housing costs. Remember, there is no landlord to call if the plumbing backs-up or the refrigerator dies. Things happen when you own a home, and you need to be prepared to pay for all items not covered by insurance or a home warranty. Find a local real estate agent to trust. Just because your cousin is a part-time agent, doesn’t mean he or she is the best choice to represent you as a buyer. Instead, look for an experienced agent who knows the area you are targeting for your home search; someone who has first-hand knowledge of the various neighborhoods, shopping, schools and other amenities. Ask your friends for referrals and check online references. Don’t hesitate to interview several people to find the real estate professional you feel will be there to answer your questions and patiently guide you through the home-buying process. Working with an agent whose advice you trust and respect will help keep the peace if negotiations get tough or you encounter unforeseen obstacles. Be prepared for a reality check. Many first-time buyers have an inflated view of what their money should buy. It is unlikely that you will find everything on your wish list. Market price is driven by comparative sales. Just because you think a home is worth $300K means nothing if a comparable property just sold for $400K. Go big or you won’t be going home. Be ready to act. You have to get in the game. Sure, writing an offer is scary and often first-time buyers want to “think on it” for a few days, or wait to bring their parents or friends to see the property and get a second opinion. Unfortunately, depending on your market, your dream home might be under contract by the time you decide to act. Couples frequently have one member of the relationship who is reticent to take action. Take a deep breath and trust your gut, your partner, and your agent. Under most real estate contracts you also have a contingency period to investigate the property and pull-out if dissatisfied without losing your deposit. Get ready for some tough talk from the inspector. Your offer has been accepted; you’ve mentally decorated every room and can’t wait to move in. And then, the inspector arrives. You have hired him or her to uncover any problems, but you dread the results. Please be reassured that EVERY home has issues, even a new build. A thorough inspection is the best thing you can do for your long-term peace of mind. Talk with your agent about the inspection results and based on a non-emotional evaluation you can a) cancel the contract; b) request the seller to make certain reasonable repairs or credits based on the price you have offered; or c) have a good list of minor things that should probably be attended to in the next year or so. Never assume that because everything was remodeled there are no problems. Always pay for a thorough inspection. It is worth every dollar you spend. Bring your best game. Once you are in escrow there will be forms and many requests for information from title companies, lenders and possibly attorneys, depending on where you live. Be timely in providing any requested information or documentation so as to not delay closing. If either of you are unclear about any step along the way, don’t hesitate to ask questions. This is likely the biggest purchase you will ever make and you are both entitled to understand the transaction. Ultimately, first-time home buying harmony is as simple as following these few tips, clearly communicating with one another, and keeping things in perspective. Oh, and a sense of humor doesn’t hurt! *Article compliments of Forbes.com Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but arn't quite sure? Thinking about when you should make the move and set out to make a purchase? I can quickly provide complimentry pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. CMHC executives said the higher premiums would mean an extra $5 a month for a borrower with a 95-per-cent loan-to-value (LTV) ratio and a loan of $248,000. But the increase will be more sizable than that for many people.

The move is part of a transformational shift at the Crown corporation, which sits at the centre of the country’s housing market. CMHC is attempting to behave more like a private-sector company as the federal government seeks to reduce the housing risks that taxpayers are taking on. Mortgage insurance compensates lenders, including banks, when the mortgage borrower defaults. Federally regulated lenders are required to obtain the insurance for loans where the borrower has a down payment of less than 20 per cent. Lenders are technically responsible for the premiums, but in practice those are passed along to borrowers. CMHC expects to take in an extra $150-million to $175-million this year as a result of the price increases, although that won’t flow into profits right away because of accounting policies. The Crown corporation earned almost $1.28-billion during the first nine months of 2013. It had nearly $560-billion of insurance in force at the end of September, and insured loans for 386,222 housing units in 2012. Finn Poschmann, vice president of research at the C.D. Howe Institute, said CMHC had not been charging enough to cover its risks in the past, and the increase is a good move. “The impact will be trivial for the 80 to 85 per cent loan-to-value range,” he said. “For buyers in the 95 per cent loan-to-value range, typically first-time buyers, the changes mean a significant pop to closing costs, in the neighbourhood of $1,500. In centres like the [Greater Toronto Area] or Vancouver, the typical hit will be a lot more.” (Mortgage insurance premiums can be amortized over the length of the mortgage, rather than paid up front at closing.) He said the impact in the Greater Toronto Area would be closer to $2,000 or $10 a month. “This will make life more difficult for high LTV first-time home buyers in the big centres,” Mr. Poschmann said. “Not huge, but certainly an incentive, on the margin, to get an offer accepted and a mortgage application filed before May 1.” CMHC made the decision to boost its premiums less than two months after the government installed former investment banker Evan Siddall as CEO. CMHC’s two private-sector rivals – Genworth MI Canada, and Canada Guaranty – told Ottawa late last year they were frustrated by CMHC’s static pricing. They argued that higher capital requirements were hurting their profits, and said they would normally raise their prices in response, but felt hamstrung because CMHC is by far the biggest player in the sector. They have traditionally copied CMHC’s pricing. “Given today’s announcement by CMHC, we are currently reviewing our pricing structure to understand potential implications,” Canada Guaranty CEO Andy Charles said in an e-mail. CMHC said Friday that from now on it will announce its premiums during the first quarter each year, signalling that changes could become more common. Prior to this the last changes were between 2003 and 2005, when CMHC actually cut prices. Higher mortgage insurance premiums fit with Finance Minister Jim Flaherty’s desire to reduce the risks that taxpayers are assuming by way of the mortgage insurance system. Mr. Flaherty has repeatedly stated that CMHC has grown to become something that extends far beyond its original mandate, and he has taken numerous steps to restrict its growth. The Crown corporation was created in 1946 to help returning Second World War veterans find homes, and has become one of the country’s largest financial institutions. International observers, including the International Monetary Fund (IMF), have urged Ottawa to further reduce government’s role in the mortgage-insurance market so that more housing risk is shared with the private sector. *Article compliments of the Globe and Mail* TIP!! No matter what the cost of borrowing is it is always in your best interest to do a budget and make sure you can actually afford to buy. Time and time again purchases fail because buyers have been pre-approved without actually providing the necessary documentation to be given a firm approval. If you haven't provided your mortgage specialist with your last years Notice of assessment (NOA), a job letter from your employer, 3 months bank statements, and your last 3 pay-stubs, then chances are your not fully approved and could be denied a mortgage. Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but arn't quite sure? Thinking about when you should make the move and set out to make a purchase? I can quickly provide complimentry pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. Hot markets and cold feet might keep some people out of the housing market, but a lack of upfront cash doesn't have to be an obstacle. While it's long been the convention in the industry to start with a 20% down payment, the availability of mortgage default insurance means ownership is still possible with as little as 5% down, as long as the buyer meets industry standards of income and creditworthiness.

"What mortgage insurance allows people to do is to get into the market with today's prices, with today's low interest rates, once they have determined that home ownership is right for them," says Mary Stergiadis, principal for Ontario business development at Canada Mortgage and Housing Corp. The insurance repays lenders if a homeowner defaults on payment. People with insured mortgages can take advantage of the same interest rates as those taking out conventional mortgages, she says. And the insurance doesn't cost as much as some people think. Here's how it works: With 5% down, the insurance premium is 2.75% of the mortgage. On a $400,000 property with $20,000 down, the mortgage insurance premium would be $10,450. That would bring the total being borrowed to $390,450. Assuming a fiveyear closed at 3.75% amortized over 25 years, the monthly payment would be about $2,000, including less than $55 a month for the insurance. The same property with 20% down would have a monthly payment of $1,640. "What consumers have to ask themselves is what $60,000 means to them in terms of savings," Ms. Stergiadis says, referring to the amount needed to reach a 20% down payment for this property. "How long would it take to save that additional down payment? Where will home prices be within that time? Where will interest rates be?" The insurance rate goes down as the down payment goes up. For buyers with 10% down, for instance, the premium is 2%; with 15% down, it's 1.75%. A popular misconception is that this insurance applies only to the primary residence of the borrower. But it is also available for a second property, such as a home or condo in the city to cut a commute or to house an aging parent or a student. CMHC does not, however, insure recreational properties. Private mortgage insurers, such as Genworth Canada and Canada Guaranty, also insure high-ratio mortgages. The rates offered match those of CMHC; consumers usually aren't aware of differences, as lenders apply directly to the insurers once an offer has been made and accepted on a property. Genworth estimates about 30% of Canadian mortgages are insured, down from historical levels of as high as 40%. That percentage tends to be lower in the GTA, says Jason Neziol, Genworth's regional vice-president of sales for Ontario and the GTA. That's because higher prices mean more people make larger down payments in order to quality for mortgage loans. Mr. Neziol says private insurers play an important role in the market by providing more choice for lenders and helping to educate the public about options. "It gives options to consumers," he says. "It's good for lenders to have a choice in terms of what insurance providers would do." You don't have to be a first-time buyer in order to qualify. Plus, even conventional mortgages, those with 20% or more down, can be insured. This can happen if a loan is slightly outside of a lender's usual parameters. And there can be a rental component. A buyer can purchase a duplex with 5% down, for instance, but must live in one unit. A 10% down payment is the norm for three-and four-unit properties, where one unit is owneroccupied and the others are rented out. The point, Mr. Neziol says, is to be aware of the many options available. *Compliments of The Windsor Star* Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but arn't quite sure? Thinking about when you should make the move and set out to make a purchase? I can quickly provide complimentry pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. It’s not possible to know all that the coming year has in store for us. But, if you’re ambition is to make a move in real estate and buy a new home, preparedness is critical. Here are three qualities that can help make you a successful buyer in 2014.

Be organized You’ve heard it before. Buying a home is the largest financial purchase you will ever make. And, every level of progression along the way is important — from paperwork to viewings, offers, inspections and closing activities. The best way to be successful throughout the process is to get organized early on. Talk to your bank and a mortgage professional to get your finances in order. Ask family and friends for their recommendations and referrals on professionals to work with, including REALTORS®, lawyers and inspectors. Be sure to also organize your current household and prepare for the big move. Be informed There are plenty of factors that impact the real estate market. The area’s current and prospective job market, consumer confidence in the economy and upcoming development projects in a community can all play a part in influencing competition in the market, value of a home and the long-term return on your investment. The best way to proceed in any market, and especially in 2014, is to be informed on all the variables. In today’s online world there are plenty of resources to help you, like howrealtorshelp.ca and nsrealtors.ca, but nothing can replace the expertise, knowledge and personal service your REALTOR® can offer. Be focused There are a lot of considerations throughout the transaction of buying a house. If you’re looking now you will quickly find that there is also plenty of selection on the market. So, the final most important quality for buyers to have in order to be successful in the coming year is to remain focused. Keep your list of wishes verses needs close at hand so you don’t lose sight. Your REALTOR® will help you remain true to your budget and objectives, but once you begin to dive into the selection of listings you will want to keep this list close on hand. Viewing homes can become overwhelming, especially when there is plenty of selection on the market. Stay focused on what’s most important, get informed early on, and remain organized and you can have a successful home buying experience in the New Year. Chances are you’ll have run the numbers to determine what you can afford by way of mortgage amount and payments. But some first-time homebuyers may overlook the fact that the price paid for a home is just one of its many costs. That’s why it’s so important to understand the full cost of buying a property.

A home inspection is the most widely recognized pre-closing cost. It may be seen as an optional expense but it’s also a smart one is because a qualified home inspector, engineer or contractor can identify underlying problems with a home’s major systems, like heating and electrical. If you’re thinking of saving some money by skipping an inspection, ask yourself, “Can I afford to learn about major, costly problems after I take possession?” If you’re buying in a rural area, you should also have the septic system inspected and water testing conducted for the good of your health. Your lender may require, as a condition of financing, that you pay for an appraisal or survey of the property to ensure the home’s value matches its sale price. Closing costs typically make up the bulk of the additional expenses. In Nova Scotia, a land transfer tax is up to 1.5 per cent of the purchase price. As a first-time buyer, you should talk with your real estate agent about whether you are eligible for a refund of the land transfer tax. Legal fees will need to be paid to handle the documents and contracts involved in the purchase of a home. Your lawyer will conduct a title search on the home to ensure the seller can actually sell the property and that there are no liens against it. They will also register the deed and mortgage for you. You may also need to refund the seller for pre-paid expenses — property taxes, maintenance fees, utilities, hot water heater rental fees. Three different insurance policies round out the closing expenses. You’ll need mortgage insurance if your down payment is less than 20 per cent of the sale price. You’ll need home insurance. And title insurance will protect you against title fraud, errors in surveys and encroachment issues with neighbours. After-closing costs include moving expenses. Some gas, hydro and water companies charge a hook-up fee and you’ll need to pay if you want to forward your mail from your old address. Then you’ll need to factor in what you want to do with the dated kitchen and broken fence. If you want to renovate or take care of some repairs identified during the home inspection, it will add to your costs. A fresh coat of paint, some window coverings, or perhaps a shiny new fridge and stove also add up. Understanding the full cost of buying a home will help to budget for these final touches. The latest edition of RECO’s consumer newsletter, RECOnnect, has a useful overview of these costs. You can find it on the consumer side of RECO’s website, reco.on.ca, under ‘Publications and Resources’ TIP! When your doing a budget for your purchase spending some time to ensure you have the money you need is a must. Countless new homebuyers get caught up in being pre-approved and forget to ask the right questions. These fees may include lawyers fees, home inspection, septic inspection, water tests, tax adjustments, oil adjustments, Are you looking for a Realtor in Halifax? Thinking it may be the time to sell but aren't quite sure? Thinking about when you should make the move and set out to make a purchase? I can quickly provide complimentary pressure free appraisals or answer any questions you have regarding mortgages, renos and real estate. Contact me or feel free to leave a public comment or question below. Follow me on Twitter and Facebook to see more updates and see what is going on in Nova Scotia real estate. |

Jason Shadbolt, BMgtAs a Realtor, Builder and previous Mortgage Specialist, if you have questions, all you have to do is ask! |

RSS Feed

RSS Feed